is there real estate transfer tax in florida

The average property tax rate in Florida is 083. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

Florida Lady Bird Deed Form Get An Enhanced Life Estate Deed Form

In Florida this fee is called the Florida documentary.

. If passed this new transfer tax would be 20 for amounts over 2. Documents that transfer an interest in Florida real property such as deeds. There is currently no.

The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every. The Florida documentary stamp tax is a real estate transfer tax. Real Estate Transfer Tax Florida imposes a transfer tax on the transfer of real property in Florida.

This tax is normally paid at closing to the Clerk of. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. The Massachusetts real estate transfer excise tax is currently 258 per 500 value transferred which is a 0456 tax rate.

For the purposes of determining. This fee is charged by the recording offices in most counties. There is no specific exemption for documents that transfer Florida real property for estate planning.

Massachusetts MA Transfer Tax. Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. Call The Law Office Of Richard S.

Does Florida have real estate transfer tax. Sales and Use Tax. Since there is no other consideration for the transfer.

Each county sets its own tax rate. There are also special tax districts such as schools and water management districts that. In all areas except Miami Dade County the tax rate is 70 for every 100 paid for the.

The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. Measure ULA commonly known as the mansion tax would impose a new Homelessness and Housing Solutions Tax on transfers. November 14 2022.

The state of Florida commonly refers to transfer tax as documentary stamp tax. In Florida there is a real estate transfer tax referred to as the Florida documentary stamp tax. The tax is called documentary stamp tax and is an excise tax on the deed.

Its customary for the seller of the property to pay for this tax in Florida. Further for all other types of transfers in Miami-Dade. Are there real estate transfer taxes in California.

Property Tax Exemptions and Additional Benefits. The Director Real Estate Transfer Tax will play an instrumental role in the development of the Real Estate Transfer Tax section of the Property Tax Consulting Practice. Miami-Dades tax rate is 60 cents.

People who transfer real estate by deed must pay a transfer fee.

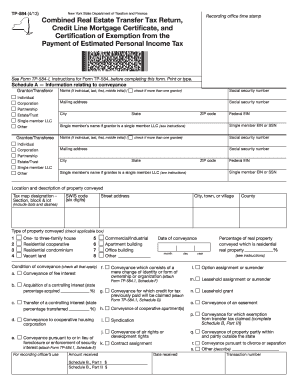

Real Property Transfer Tax Return Free Download

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Florida Seller Closing Cost Calculator 2022 Data

What Is The Florida Documentary Stamp Tax

Calculating State Transfer Taxes In Florida Florida Real Estate Exam Math Tutorial Youtube

How Much Does It Cost To Sell A House Zillow

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

Florida Real Estate Taxes And Their Implications

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Documentary Stamp Tax Guide 2022 Propertyclub

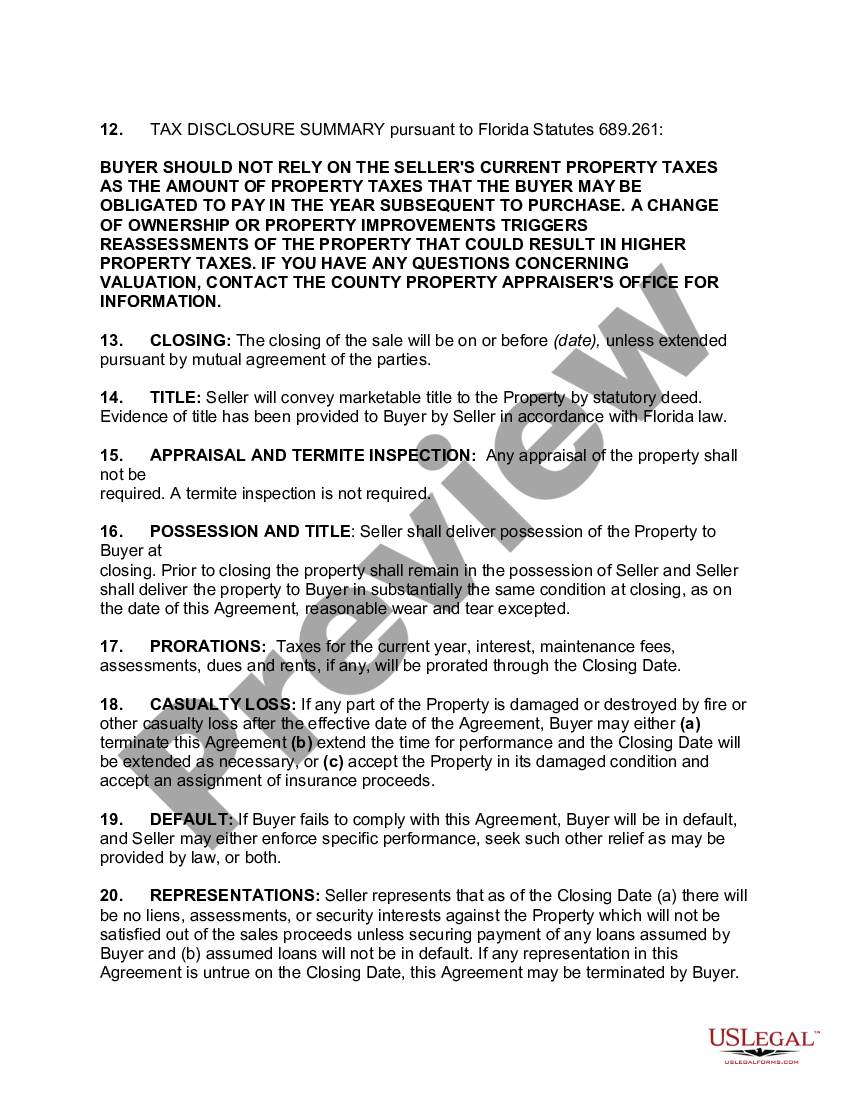

Florida Agreement For The Purchase And Sale Of Real Estate Transfer Of Title From One Joint Owner To Other Joint Owner Us Legal Forms

Free Real Estate Purchase Agreement Rocket Lawyer

Alabama Real Estate Transfer Taxes An In Depth Guide